C21 Investments Announces Q3 Results

Net Income of $2.3 Million Highlights Strong Profitability

VANCOUVER, December 16, 2020 – C21 Investments Inc. (CSE: CXXI and OTCQX: CXXIF) (“C21” or the “Company”), a leading vertically integrated cannabis company, today announced unaudited results for its third quarter ended October 31, 2020.

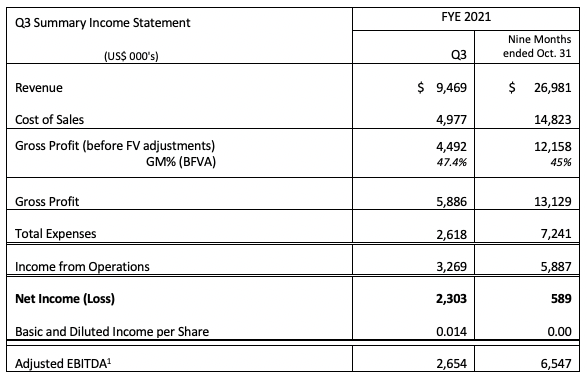

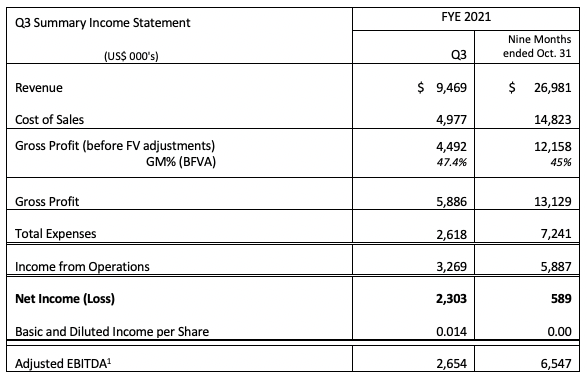

Q3 Financial Highlights: (all currency in U.S. dollars)

(August 1, 2020 to October 31, 2020):

- Revenue of $9.5 million – a record $8.9 million from Nevada’s retail operations with same-store sales up 5% from Q2

- Gross Profit of $5.9 million; Gross Margin (before fair value adjustments) of 47.4%

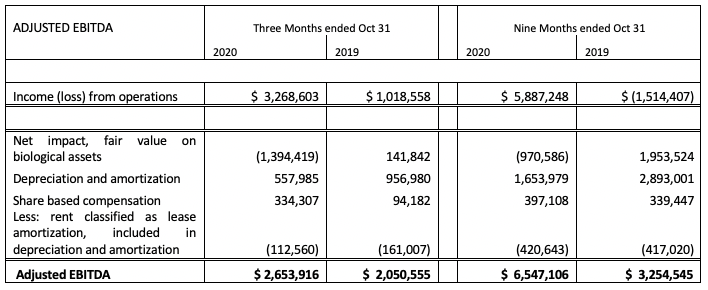

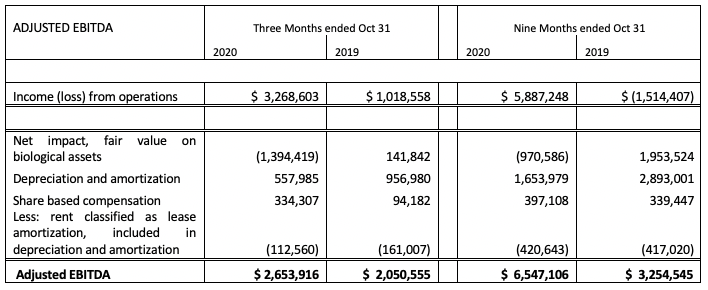

- Adjusted EBITDA1 of $2.7 million, the seventh consecutive quarter of positive EBITDA

- Cash Flow from Operations of $3.1 million; Year-to-Date results of $8.7 million, up 175% from last year

- Net Income of $2.3 million

President and CEO Sonny Newman: “C21 has achieved a number of record results this quarter as evidenced by our strong earnings. With our recently announced note restructuring and debenture backstop, we have fortified our balance sheet. We are now focused on the next logical step of our growth strategy – the expansion of our Nevada cultivation and production facility. This puts us in an excellent position to extend our retail footprint in the state. We have built a profitable, scalable business and remain focused on expanding our share of the Nevada market where we have a proven track record of success and on delivering results for our shareholders.”

Management Commentary:

Revenue for the quarter was $9.5 million, with record revenues of $8.9 million from Nevada’s retail operations. Nevada revenues were up 5% from the strong performance reported in Q2. This resulted in Gross Profit of $5.9 million. Before fair value adjustments, Gross Profit was $4.5 million, a 47.4% Gross Margin. Nevada also reported record same-store sales and has generated a 52% Gross Margin year-to-date. Challenges within the Oregon operations resulted in lower revenue and gross margin being reported this quarter.

Adjusted EBITDA1 was $2.7 million in the quarter (28% EBITDA margin), and adjusted EBITDA1 year-to-date totalled $6.5 million (24% margin). For the third quarter, SG&A was $1.7 million. On a year-to-date basis, SG&A expenses were $5.2 million (19% of revenue) versus prior year-to-date of $8.4 million (30% of revenue).

Continued strong cash flow from operations delivered $3.1 million in the quarter. Year-to-date, cash flow from operations of $8.7 million was up 175% from last year, also surpassing the prior full year results of $5.5 million. This enabled C21 to pay down $5.4 million of debt in the nine-month period.

C21 reported Net Income of $2.3 million for the quarter, also a record for the Company. The Company’s strong results delivered $0.014 Earnings Per Share in Q3 and an earnings-positive result year-to-date with Net Income of $475,000.

Subsequent to the Third Quarter:

The Company has continued to pay down its debt, reducing the principal amount of its notes payable by an additional $1.1 million, bringing the year to date total paid down by cash flow from operations to $6.5 million.

In the press release, dated November 19, the Company announced that the principal amount of the Company’s senior secured note held by CEO Sonny Newman had been restructured for repayment over a 30-month term. The Company also announced it had secured a commitment from three investment managers — Wasatch Global Investors, JW Asset Management and CB1 Capital Management — who, in addition to CEO Sonny Newman, provided an equity commitment for repayment of all of the Company’s existing convertible debentures which remain outstanding at maturity. The Pro Forma Balance Sheet table below (see further in MD&A) assumes these changes were they to have occurred before quarter end.

In the press release, dated December 2, C21 announced the planned expansion of its licensed cultivation and production facility in Nevada – a 40,000 square foot buildout to existing operations, including eleven new flowering rooms and two new vegetative rooms. This 200% of additional canopy is expected to yield an incremental 7,500 pounds of premium indoor flower and 3,000 pounds of trim/biomass annually. The Company expects the expansion to be funded internally at a cost of approximately $6 million.

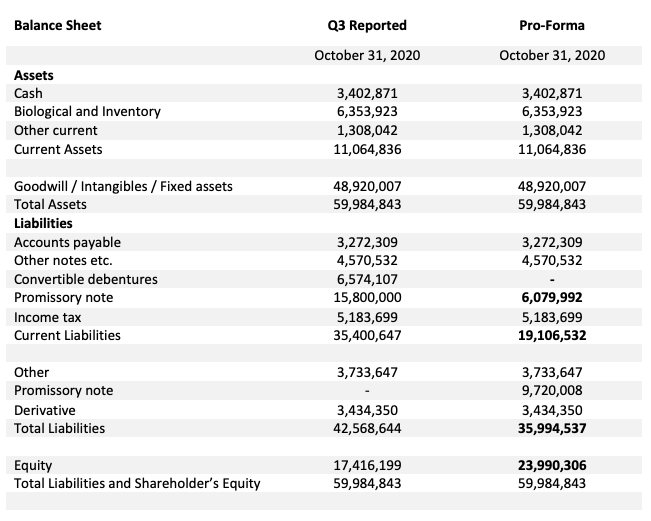

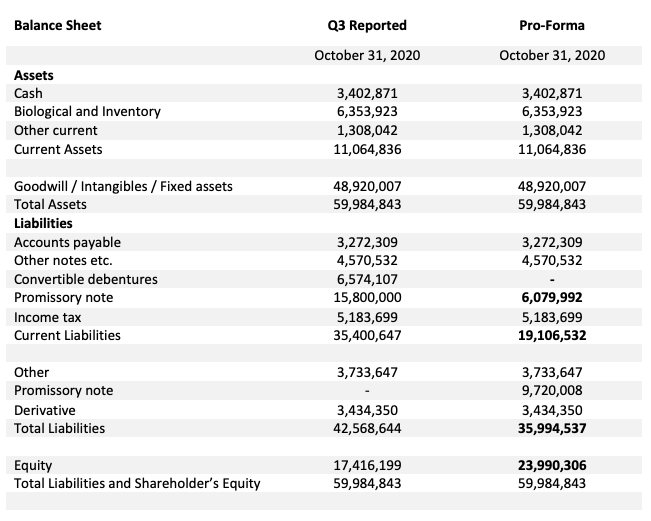

Pro-Forma Balance Sheet:

As noted above, on Nov 19, 2020 the Company announced deals with respect to two significant debts, both classified as current liabilities on the Company’s Balance Sheet. The repayment of the convertible debentures maturing on December 31, 2020 and January 30, 2021 has been guaranteed by a group of investors, and the promissory note owed to the Company’s CEO has been amortized over 30 months.

Below we are presenting a Pro-Forma Balance Sheet as at October 31, 2020. This Pro-Forma Balance Sheet recognizes these developments as follows:

- the promissory note restructuring as if it were effective at Oct 31, 2020.

- The guarantee of the debentures ensures that the debentures will all be converted to shares at each of the maturity dates. This Pro-Forma Balance sheet reflects this conversion to shares of all the December 31, 2020 and January 30, 2021 convertible debentures outstanding as if this occurred at Oct 31, 2020.

- For continuity, we also present the October 31, 2020 balance sheet as presented in the accompanying Q3 interim financial statements.

| Media contact: Mattio Communications c21@mattio.com |

Investor contact: Michael Kidd Chief Financial Officer and Director Michael.Kidd@cxxi.ca +1 833 BUY-CXXI (289-2994) |

About C21 Investments Inc.

C21 Investments is a vertically integrated cannabis company that cultivates, processes, and distributes quality cannabis and hemp-derived consumer products in the United States. The Company is focused on value creation through the disciplined acquisition and integration of core retail, manufacturing, and distribution assets in strategic markets, leveraging industry-leading retail revenues with high-growth potential multi-market branded consumer packaged goods. The Company owns Silver State Relief and Silver State Cultivation in Nevada, and Phantom Farms, Swell Companies, Eco Firma Farms, and Pure Green in Oregon. These brands produce and distribute a broad range of THC and CBD products from cannabis flowers, pre-rolls, cannabis oil, vaporizer cartridges and edibles. Based in Vancouver, Canada, additional information on C21 Investments can be found at www.sedar.com and www.cxxi.ca.

Cautionary Statement:

Certain statements contained in this news release may constitute forward-looking statements within the meaning of applicable securities legislation. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Forward looking statements in this news release include the Company’s positioning in the United States cannabis industry, the assumptions and developments included in the Company’s pro-forma balance sheet as at October 31, 2020, the ability of the Company’s Nevada retail locations to operate at record run rates, the performance of the Company’s operations generally, and specifically its Nevada retail operations, during the pendency of the COVID-19 pandemic, the continued profitability of the Company’s Nevada operations as a standout in the cannabis sector, the Company’s ability to continue to service its debt through operating cash flows, the Company’s ability to pursue growth opportunities and generate future growth for the Company by scaling and replicating its profitable model in Nevada, including the expansion of its existing cultivation and production facility, the ability of the Company to secure a non-dilutive debt financing, the performance of the Company’s brands and the continued demand for cannabis products, and the nature and extent of the impact of the COVID-19 pandemic.

The forward-looking statements contained in this news release are based on certain key expectations and assumptions made by the Company, including the ability of the Company to restructure its secured debt and to service its restructured debt. Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, the consequences of not restructuring its secured debt, the ability to service its debt, if restructured, risks and uncertainties arising from the impact of the COVID-19 pandemic on the Company’s operations, and other factors, many of which are beyond the control of the Company.

The forward-looking statements contained in this news release represent the Company’s expectations as of the date hereof, and are subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.